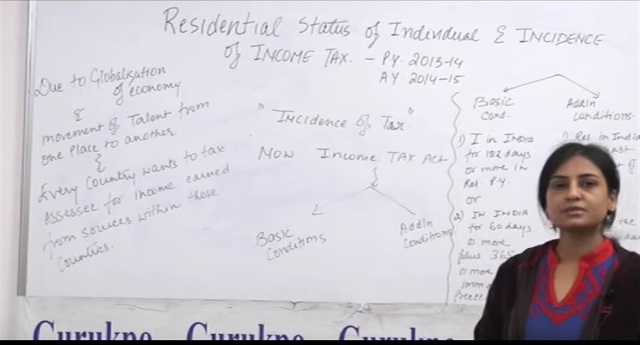

In this Video, Ms. Mandvi Sharma, Guest faculty, Biyani Group of Colleges explains that why it is important to determine the Residential Status of an Individual , How the same is determined and what is the incidence of tax. Basic conditions and Additional conditions, which are used to determine the Residential status of an Individual, are discussed in details along with exceptions. The rules for determining ROR (Resident and Ordinary Resident) and RNOR (Resident but not Ordinary Resident) status of an individual are also discussed in this video. It is further concluded that depending upon the residential status what type of income is chargeable to Indian Income tax.